RegTech Ireland (Regulation + Technology + Ireland)

Like Financial Services + Technology = Fintech*, so too is Regulation advancing via the rapid adoption of technology. Again like the term Fintech, RegTech might be appear to be a newly coined buzzword, but in fact it has been around for quite sometime. Not everyone will agree a universal definition for RegTech (as is the case for FinTech) but that doesn't matter.

Essentially we are seeing technology and regulation advancing in many ways, including leveraging big data in order to ensure proper regulatory reporting and compliance with global prudential & conduct risk requirements.

Following the financial crisis, regulators around the world recognise that firms have to deal with greater reporting requirements and meet higher regulatory standards. In order to enable effective competition and promote innovation, it is important that technologies that help firms better manage regulatory requirements and reduce compliance costs are supported. In the UK the conduct regulator, the Financial Conduct Authority, is working with its counterpart, the Prudential Regulatory Authority to identify ways to support the adoption of new technologies to facilitate the delivery of regulatory requirements via RegTech. The same is happening across the world.

Email us at HELLO AT REGTECHIRELAND.COM (of course, replace the AT with @ symbol!]

*see https://fintechireland.com and https://fintechuk.com

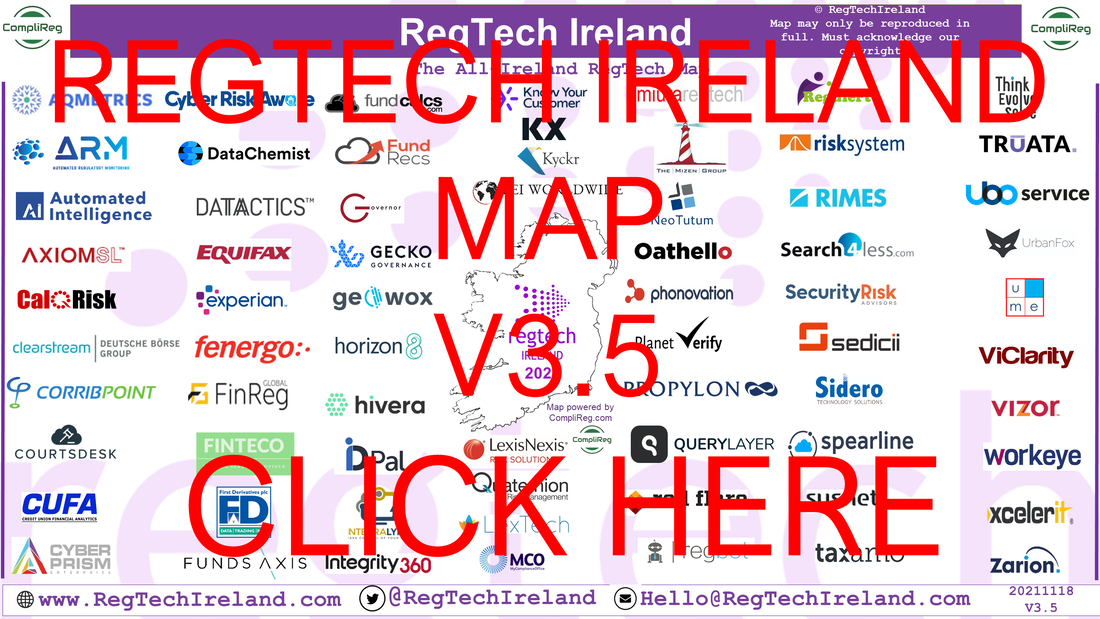

Want to see Ireland's thriving indigenous Regtech community, visit the Fintech Ireland Map here.

If you are Irish Regtech and are not on the map - complete the Fintech Ireland Survey here

Wish to become a Network Partner? More information here.

Like Financial Services + Technology = Fintech*, so too is Regulation advancing via the rapid adoption of technology. Again like the term Fintech, RegTech might be appear to be a newly coined buzzword, but in fact it has been around for quite sometime. Not everyone will agree a universal definition for RegTech (as is the case for FinTech) but that doesn't matter.

Essentially we are seeing technology and regulation advancing in many ways, including leveraging big data in order to ensure proper regulatory reporting and compliance with global prudential & conduct risk requirements.

Following the financial crisis, regulators around the world recognise that firms have to deal with greater reporting requirements and meet higher regulatory standards. In order to enable effective competition and promote innovation, it is important that technologies that help firms better manage regulatory requirements and reduce compliance costs are supported. In the UK the conduct regulator, the Financial Conduct Authority, is working with its counterpart, the Prudential Regulatory Authority to identify ways to support the adoption of new technologies to facilitate the delivery of regulatory requirements via RegTech. The same is happening across the world.

Email us at HELLO AT REGTECHIRELAND.COM (of course, replace the AT with @ symbol!]

*see https://fintechireland.com and https://fintechuk.com

Want to see Ireland's thriving indigenous Regtech community, visit the Fintech Ireland Map here.

If you are Irish Regtech and are not on the map - complete the Fintech Ireland Survey here

Wish to become a Network Partner? More information here.